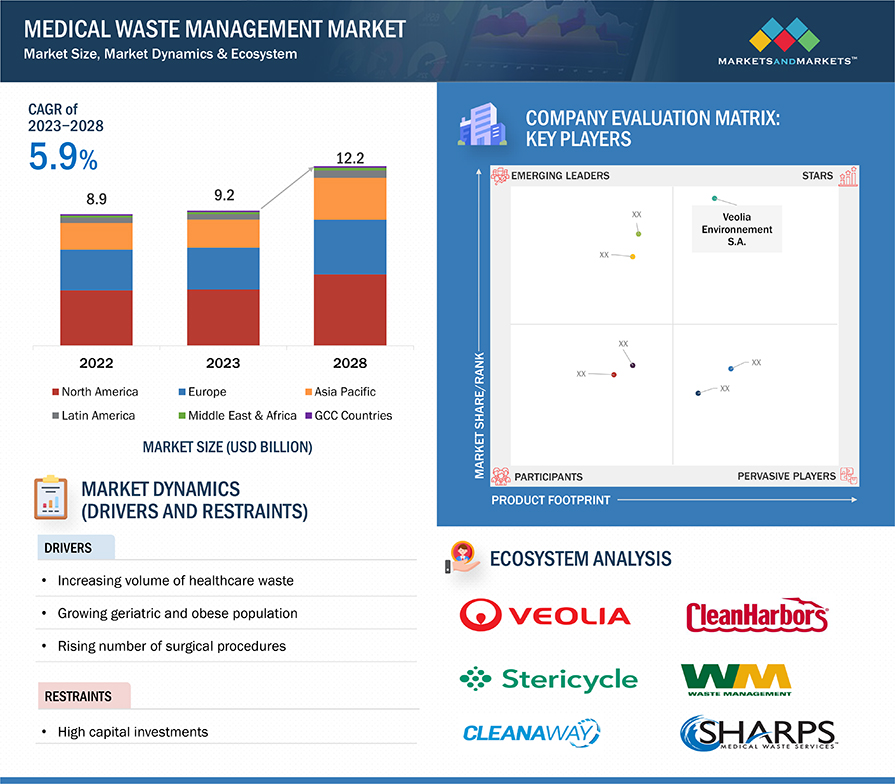

Medical Waste Management Market, is projected to reach USD 12.2 billion by 2028 from USD 9.2 billion in 2023, at the CAGR of 5.9%. The increase in investments by research centers, increased number of hospitals, research laboratiories, diagnostic laboratories generating a huge amount of medical waste, improving focus on reducing the medical waste and proper management of medical waste has expected to increase the medical waste management market. Moreover the advancements in the medical waste management technologies like incineration, auto cloaving and rising demand of these technologies combined with stringent government regulations for the disposal of medical waste in various countries for controlling the spread of infections and growing focus on the hazardous impact of medical waste on the environment will also support the growth of this market.

Download Report Brochure @https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1256

Browse in-depth TOC on " Medical Waste Management Market”

235 – Tables

39 – Figures

231 – Pages

Key Market Players

The major players operating in this market are Veolia Environnement S.A. (France), Clean Harbors, Inc. (US), Stericycle Inc. (US), Waste Management, Inc. (US), Cleanaway Waste Management Limited (Australia), Casella Waste Systems, Inc. (US), Sharps Compliance, Inc. (US), Covanta Holding Corporation (US), Hazardous Waste Experts (US), REMONDIS SE & Co. KG. (UK), BioMedical Waste Solutions, LLC (US), EcoMed Services (Canada), GRP & Associates, Inc. (US), BWS Incorporated (US), MEDPRO Disposal LLC (US), GIC Medical Disposal (Canada), Gamma Waste Services (US), Triumvirate Environmental (US), EPCO (Saudi Arabia), All Medical Waste Australia Pty Ltd. (Australia), Pro-Disposal Medical Waste Services (Georgia), SSO Medical Waste Management (US), Safeguard Waste Solutions (US), MedWaste Industries Inc. (US), DULSCO (UAE).

DRIVER: Increasing volume of healthcare waste

The medical waste management market has experienced substantial growth due to the expansion of the healthcare industry. This growth is attributed to the rising demand for healthcare services worldwide, which has led to an increase in the number of hospitals, laboratories, research centers, mortuaries, autopsy centers, blood banks, and related collection activities. As these healthcare facilities expand their operations to meet the growing needs of patients, there is a parallel increase in the generation of medical waste. Consequently, there is a heightened demand for efficient medical waste management solutions to handle the larger volumes of waste produced. This trend underscores the critical importance of effective waste management practices within the healthcare sector to ensure public health and environmental safety.

RESTRAINT: High capital investment

Hospitals, healthcare institutions, and pharmaceutical companies face substantial capital requirements for effectively managing the collection and processing of waste in a manner that minimizes environmental pollution. This includes both hazardous and non-hazardous waste, for which advanced technologies and significant investments are necessary for proper disposal. These entities must allocate resources towards implementing sophisticated waste management systems to ensure compliance with environmental regulations and mitigate the impact on ecosystems. Such investments are crucial not only for meeting regulatory standards but also for safeguarding public health and preserving environmental integrity. Therefore, there is a pressing need for these organizations to prioritize substantial financial commitments towards adopting sustainable waste management practices that prioritize environmental sustainability and community well-being.

Request Free Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1256

OPPORTUNITY: Increasing number of awareness programs for medical waste management in developed countries

In developed nations such as the US and UK, there has been a notable rise in initiatives aimed at promoting awareness regarding proper medical waste management and the prevention of mishandling. This surge includes the organization of awareness programs and conferences dedicated to educating stakeholders about the importance of effectively managing medical waste. These initiatives aim to highlight the potential risks associated with improper disposal practices and emphasize the need for adherence to established protocols and guidelines. By increasing awareness among healthcare professionals, policymakers, and the general public, these efforts seek to foster a culture of responsible waste management practices. Ultimately, the goal is to mitigate environmental harm, protect public health, and enhance overall sustainability within these nations' healthcare systems.

In 2022, collection, transportation and storage services segment accounted for the largest share of the medical waste management industry, by services.

Based on services, medical waste management market is segmented into collection, transportation and storage services, treatment & disposal services and recycling services. In 2022, collection , transportation and storage services held the second highest CAGR. The growth rate of this market can be attributed to the improved public and government perception on the importance of medical waste management and healthcare cost reduction by appropriate disposal of waste.

In 2022, non-hazardous waste segment accounted for the largest share of the medical waste management industry, by type of waste segment

The medical waste management market is segmented into non-hazardous waste and hazardous waste based on type of waste. In 2022, the non-hazardous waste segment accounted for the largest share. Factors such as increased number of healthcare procedures related to chronic diseases as well as burns and accidents and rising economic developments along with improved healthcare facilities and infrastructure and revised regulatory guidelines for waste management leads to market growth.

In 2022, offsite treatment segment accounted for the largest share in the medical waste management industry, by treatment site

Based on treatment site, the medical waste management market is divided into offsite treatment and onsite treatment. Offsite treatmemt segment held the highest market share in 2022. Understanding the waste to energy opportunities during by waste management and increased collaboration between the healthcare facilities and medical waste management services for addressing complex medical waste management are the factors contributing to the growt of this market.

Hospital & diagnostic laboratories segment accounted for the largest share in the medical waste management industry in 2022, by waste generator

The medical waste management market is divided into hospitals & diagnostic laboratories and other waste generators based on waste generator. The hospital & diagnostic laboratories accounted for the highest market share along with highest growth rate in 2022. Increasing number of awareness programs and conferences for new technologies and practices for medical waste management in developed as well as developing countries is driving the growth of this segment.

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1256

North America is the largest regional market for medical waste management industry

Based on region, the medical waste management market is divided into mainly six regions – North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries. North America held the largest market share of the market in 2022 and the Asia Pacific is estimated to have highest growth rate. The North American market's growth can be attributed to the advancements of the healthcare industry and rising healthcare expenditure. Wheres there is a lot of improvement in the healthcare facilities in the Asia Pacific regions along with increased medical tourism leading to the higher growth rate.

Recent Developments:

- In December 2021, the Veolia Environment S.A. launched the Vigie COVID-19 solution, which can track signs of the Omicron variant in wastewater, acting as an early warning system for monitoring the progression of the pandemic.

- In May 2022, Veolia Environment S.A. acquired Suez Environment. The companies signed an agreement for the acquisition of all of the hazardous waste assets in France to address the European Commission competition concerns made by Veolia.

- In October 2020, Waste Management, Inc. acquired Advanced Disposal. This acquisition expanded Waste Management’s footprint and provided access to sustainable waste management and recycling services for customers in the US.